THE SHIFT | The Rules of The Game: Legislation, Policy, and What it Means for Development

“The Waiting Game” is a phrase often used to describe today’s commercial real estate market. While this game of patience is not new to owners and developers, it has extended far beyond typical tolerance levels.

Real estate, by its very nature, is a cyclical industry marked by periods of triumphant highs and arduous lows. To survive in this industry, you must not think of it as a sprint, but rather a marathon. It is a test of endurance, pacing, and most importantly, determination.

But these days, it doesn’t seem like owners and developers are running a marathon. Instead, it feels as if we are playing a game of chutes and ladders. No longer taking steps forward, we are trying to climb our way back to the road, only to be sent sliding back to start to try again.

But why is this? And who or what keeps sending CRE back to start?

In this case, it’s not as easy as blaming your older sibling. There are too many factors at play. We can, however, look to the rules to find some answers.

Before we look at the rules themselves, it’s important to first understand how “the game” works. In today’s article, we’ll dive deeper into the legislative landscape of commercial real estate, how it affects future development, and what we can do to ensure everyone can keep playing.

CRE: The Waiting Game

Who Are The Players?

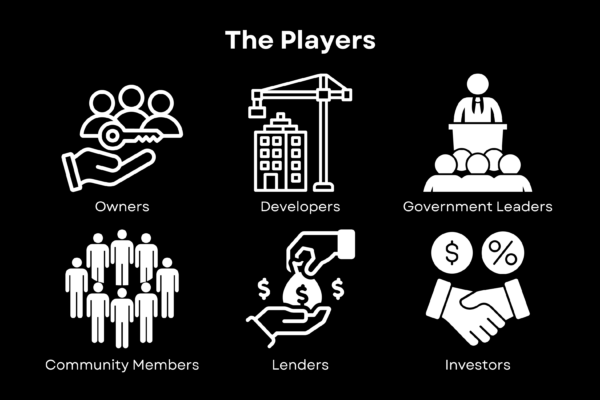

To understand the “rules of the game”, we must first establish who’s playing. On a broad scale, we all participate by how we vote, where we do business, or what neighborhood we live in, but for the purpose of this piece, we are narrowing it down to six key players: Owners, Developers, Government Leaders, Lenders, Investors, and The Community.

- Owners: Operate and upgrade existing buildings to meet community needs

- Developers: Construct new buildings to support community needs and further the region’s economic development

- Government Leaders: Create policy and legislation to advance economic development and support the health and safety of the community.

- Lenders: Provide loans (debt) for real estate projects, assessing financial viability and risk. They include banks, credit unions, and financial institutions, influencing project scope through loan approvals and terms.

- Investors: Supply capital (equity) for projects, seeking returns on their investments. They range from individuals to large firms like REITs and private equity, playing a key role in funding and sustaining real estate developments

- The Community: Provides opinions and preferences that owners, developers, and government leaders listen to and respond to. This includes not only the general community, but building tenants and residents as well.

What are “The Rules” and Who Makes Them?

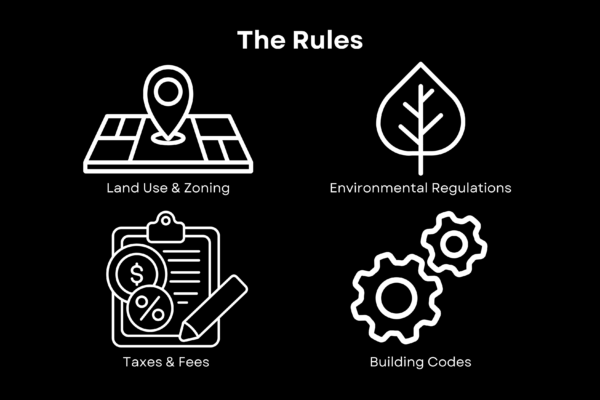

As a whole, government regulations are “the hard rules” owners and developers must abide by. These regulations have a major impact on commercial real estate development and typically cover areas such as land use and zoning, taxation and fees, licensing, environmental standards, building codes, and construction.

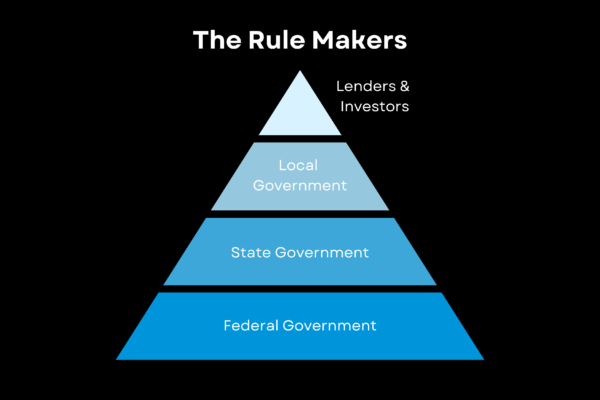

They are set by the three key parties below:

- Federal Government: Creates the foundation for policies including widespread legislation, development initiatives, and incentives. Additionally, the Federal Government controls other development factors such as inflation, interest rates, and major economic and fiscal policies.

- State Government: Adds additional policies and legislation to optimize for the region. Think of it as a “special edition” to the “master game” to include items like additional taxes, fees, construction, environmental, and code compliance aimed to support the growth and well-being of the state.

- Local Government: The “extension pack”. The local government creates policies and legislation to help direct the growth and safety of its citizens; creating additional regulations in areas like zoning, energy efficiency, building codes, taxes, fees, and additional requirements such as public art, safety measures, and transportation.

While each body of government has varying degrees of impact and reach, these three work together to create the legislative landscape owners and developers must navigate, and by proxy residents, tenants, and community members then experience. Today, these broader impacts are experienced through shortages in housing supply and affordability, delayed construction on new projects and building upgrades, public safety, and employment (or lack thereof).

There are also a set of “soft rules” owners and developers must abide by. These are set by the investors and lenders who determine what they will and will not invest in– Or otherwise, what projects they will fund. In order to “play by the rules” here, owners and developers must show how they will reach certain financial metrics including IRR (internal rate of return), yield on cost, loan-to-value, or DSCR (debt service coverage ratio) to ensure their projects are financeable.

The Rules

These regulations aim to direct economic growth and create environments that are well-suited for commerce and culture. Additionally, they work to promote public safety, transportation, healthcare, education, childcare, hospitality, and environmental stewardship.

Below are the major regulation areas affecting development:

- Land Use and Zoning: Land use refers to how land is utilized, such as for residential, commercial, industrial, or agricultural purposes. Zoning involves dividing land into different zones based on its designated use, like separate zones for single-family homes, commercial buildings, and multi-family buildings. This system aims to create organized communities with appropriate infrastructure (roads, utilities, public services) and protect property values and character by controlling nearby developments.

- Environmental Regulations: These laws and policies protect the natural environment by managing development impacts. They address air quality, water pollution, waste management, and land use planning, aiming to balance economic growth and environmental protection. Compliance with building codes and standards promoting energy efficiency and sustainability is also crucial; with many cities now requiring developers to follow green building practices, such as using renewable energy sources and incorporating water-saving features.

- Taxes + Fees: These are levied by local governments to fund public services and support initiatives like affordable housing and sustainable development. Taxes and fees play an important role in determining how much developers and lenders are willing to invest in projects as they heavily impact ROI.

- Building Codes: Set the standards for the construction and renovation of commercial properties. Building codes establish minimum standards, such as structural integrity, fire safety, accessibility, electrical systems, plumbing, and energy efficiency to ensure the safety and comfort of tenants.

Wildcards

No good game is complete without wildcards. While these are unpredictable by nature, their impacts can range from minor inconveniences to major effects. Commercial Real Estate’s most recent wildcards include:

- Hybrid/Remote Work: The shift to hybrid/remote work has dramatically altered the office market, reducing demand for traditional office spaces and changing location and size preferences as companies adapt to flexible work arrangements.

- Changing Interest Rates: High interest rates have reduced financial liquidity and project feasibility, making it more challenging for developers to secure affordable financing for new projects and renovations.

- Rising Inflation: Recent inflation has increased operating expenses for property owners and developers, driving up costs for materials, labor, and services, and squeezing profit margins.

- Supply Chain + Labor Shortages: Ongoing supply chain disruptions and labor shortages have impacted the cost and timing of building upgrades and new developments, causing delays and increased expenses.

- Unemployment: Seattle’s fluctuation in employment rate has influenced tenant demand and occupancy levels, affecting rental income and property values in both the commercial and residential sectors.

- Resident + Tenant Expectations: As a result of the pandemic, there is a dramatic shift in expectations from residents and tenants experienced by the “flight to quality” and demand for more sustainable and technologically advanced buildings. This pronounced change in preferences requires owners and developers to invest in upgrades and new features to remain competitive.

- Cultural + Demographic Trends: Changing cultural and demographic trends, such as preferences for urban living and neighborhood/city affect the population influencing market dynamics and the types of developments in demand. Locally, we’ve seen an eastern population shift, increasing demand and development in Bellevue and Issaquah.

So…How Do You Play?

There are no written rules as to exactly how one plays, rather owners and developers must be agile in responding to the needs of the community and their tenants while navigating the legislative and economic environments.

While there isn’t a manual to follow, there is one key fact that every real estate professional knows: Timing is key. It’s crucial not only to respond to the needs of the community but to do so at the right moment to achieve success, both for community growth and business goals. This requires a deep understanding of the rules and regulations that apply, enabling quick and effective action to meet demand.

However, working quickly still takes time. On average, a new development takes roughly 5-7 years to complete.

The Development Process Occurs in 7 Stages:

- A developer identifies a community need and creates a concept for a new project

- The project is researched, evaluated, and underwritten.

- A site is purchased (typically with equity and/or debt)

- The project moves forward as a pre-leased building or on a speculative basis.

- The site is permitted with a development team typically consisting of an architect, contractor, engineer, attorney, and consultants.

- Once the market allows, the development team is deployed to break ground on the site and administer construction.

- The project is completed and is turned over to a tenant-in-tow, or is added to the available inventory of whichever sector the project is intended to serve; competing for active lease requirements in the market..

Because the real estate market is cyclical, developers are tasked with accurately forecasting demand and implementing a years-long plan to satisfy such demand without introducing too much supply or missing the market altogether.

Understanding the rules and the players in the game of commercial real estate is crucial for navigating the industry. While these regulations can be complex, they are designed to foster a balanced and safe environment for development. The landscape is ever-changing, and staying informed is crucial for successfully moving forward in the market.

In the next article, we’ll explore the challenges that have emerged in recent years and discuss how current legislation is impacting the development pipeline.