The Shift: Jordan Selig on Navigating the Commercial Real Estate Revolution

Today, the commercial real estate industry is a dynamic landscape as ownership groups work to adapt their strategies to fluctuating cultural and economic trends. Owners and operators are not only responding to remote work trends but also navigating macro-economic factors including higher interest rates and construction costs.

Due to the myriad of factors affecting the industry, commercial real estate (office space in particular) has found itself not only at the center of the news, but emerging legislation, and even a topic at the dinner table — “I mean what is going to happen to the empty buildings anyways?”.

While we could sit here and discuss all the possibilities (and we will, don’t worry), it’s important to first understand the basics. As industry leaders for over 65 years, we’ve experienced our fair share of real estate cycles. As we navigate this one, we want to share our thoughts and explore the future together.

Join us as we break down the industry, tackle misconceptions, and provide our insights and predictions into the future of CRE. Bear with us, this is our first time post-pandemic too.

___________

The Shift

We are in the midst of a commercial real estate revolution, a renaissance if you will. The very concept of the office has changed. It is no longer a mere utility, but a destination, experience, and must offer more than simply space to work. Because of this (and a few other drivers we’ll explore in a later article), owners are seeing what has been coined the “flight to quality” or the demand for premium Class A space above all else.

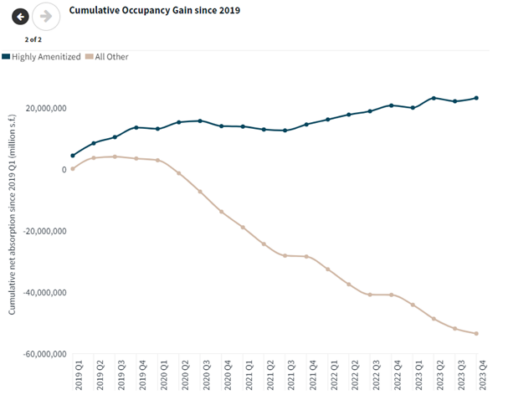

Where does this leave the other buildings? Well, like you may have seen in the headlines, Class B (traditional) and C buildings (vintage) are facing declining occupancy. In order to close the gap, ownership groups have deployed an “amenities arms race” adding premium amenities to older buildings like gyms, conference centers, coworking areas, game rooms, and more.

While not a cure-all, this has proven to be an effective solution. JLL recently released a study showing that leasing activity for highly amenitized buildings is far above the market average. In fact, there is a near-inverse relationship to leasing activity at traditional assets, highlighting the market’s change in preferences.

Not only are amenitized buildings experiencing higher leasing activity, but the study found that these amenities also act as rent drivers; generating up to 5x larger rent premiums than traditional office assets.

And while this is seeming to be an effective strategy for owners in the short term, there are two larger hurdles the commercial real estate industry must adapt to in order to stabilize:

The Concept of “The Office”

While increasing amenities is a strong first step, there is a larger question at hand— What is “the office?”. There has been a fundamental change in its purpose and role in society. Offices are no longer a utility or inelastic good, they’re a destination. Its purpose is no longer to provide a space to work, but an environment that fosters collaboration and culture. Where it is visited to achieve big things, innovate, and build; not complete day-to-day tasks like responding to emails. They must now become a desired place to be.

Building owners recognize this shift. This is the Amazon to brick and mortar, the digital to Kodak, the ______ to office. But it’s important to note that while those are all examples of major cultural shifts, we still shop, we still take photos, and of course, we still work. It’s just a matter of how.

While we don’t have enough space in this first article to explore all the “hows”, it’s important to remember that while there may be skeptics, this shift is presenting commercial real estate with the biggest opportunity it’s ever had. It’s more a question of who will take it.

Economic Implications

Now that we’ve outlined the foundation for the shift and the opportunity it presents, there is a second hurdle owners, lenders, and investors face, and one that is much further out of their control— the economy.

It’s one thing to come up with new strategies like conversions, amenitization, redevelopment, or even re-inventing “the office”, but it’s another to fund it. In addition to the decrease in revenue owners are facing, we face increased operating costs due to inflation, high interest rates, and find ourselves in an ongoing debate on the value of these buildings.

All these factors make it extremely difficult for building owners to finance and deploy new strategies that will push our industry into its next era, and as such, commercial real estate finds itself in a waiting game.

This phase of what we’ll call the “office renaissance” is receiving a lot of scrutiny. Coverage on building values, loans, and occupancy is often filled with doom and gloom, but there is a key topic forgetting to be addressed: the Lender/Borrower relationship and its broader economic impact.

Both borrowers and lenders are motivated to work together, for the benefit and protection of both parties (and for the benefit of the economy at large). It is true, yes, that some buildings have faced foreclosure, but for the most part, it is in each party’s best interests to find a mutually beneficial solution. Lending groups generally don’t want to become building operators, just as much as owners generally don’t want to hand back their buildings or file for bankruptcy. Doing so hurts both parties and has a wider impact on the U.S. economy, impacting bank liquidity, employment, and overall growth.

Banks rely heavily on returns from CRE loans, and without receiving their expected return some banks may be forced to collapse— An outcome everyone wants to avoid. Most recently estimations of nearly 300 banks are at risk due to unfulfilled CRE returns, leaving lenders in an impossible spot. Do they take a known loss now, or do they throw good money after bad?

Fortunately, we’re seeing positive momentum, especially in the Commercial Mortgage-Backed Security market (CMBS). As detailed by Trepp, office-backed CMBS loans reaching maturity are transferring to special servicing at an increasing rate, and compromised 37% of all new transfers in March. It may sound negative at first glance, but this is a positive signal of lenders and borrowers working together. The key is to look at the resolution rate.

For any modification to be made to a CMBS loan, it must go through a special servicer as they are the only authority who can make modifications to an existing loan structure. Because of this, we’re seeing an increase in the special servicing rate as part of the loan renegotiation process. In March alone, $1.7B of CMBS office debt was transferred into special servicing, and $1B of this debt reached resolution. This means that nearly 60% of the loans reached renegotiation, an incredible sign for the market and its future.

Even more, investment in the CMBS market is also pointing towards signs of recovery. In April, CMBS investment was up 170% from the previous year signaling investors’ appetite for the next era of commercial real estate.

If you look closely, we may be seeing signs of the market finally being on the upswing.

What’s Next?

There are so many more topics and factors influencing this complex industry, but for now we’re starting with the big ones. As we dive deeper, we’ll explore other topics like conversions, retail, the Seattle market, legislation, leasing, finance, and so much more.

If you’ve made it this far, we thank you for reading and hope you follow along as we navigate this dynamic landscape. And while we can’t predict the future, if previous real estate cycles have taught us anything, it’s that every downturn presents an opportunity, you just need to look for it.